Wall Street Eyes Shipping Data to Gauge Tariff Impact

Ships, trucks and railroads are helping measure the economic blow from tariffs.

Wall Street is reading the shipping news again. Scrambling to gauge how President Trump’s tariffs are flowing through the global economy, investors are seeking early signs in data from ports, truckers and railroads.

Traders often turn to shipping and logistics data when the outlook gets murky. Transportation stocks are considered a market bellwether because those companies move the goods and raw materials that power the economy. During the Covid pandemic and the 2008-09 financial crisis, investors tracked moves in an index of shipping costs for commodities such as coal, grain and fertilizer.

Here’s what they are watching now:

Goods at Southern California ports

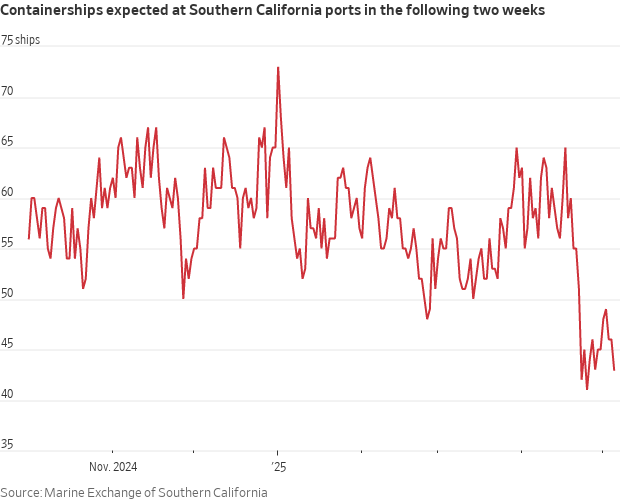

U.S. retailers and manufacturers have been stocking up on furniture, clothing, electronics and everything else that comes into the country by containership. That has caused a wave of containers to wash over the neighboring ports of Los Angeles and Long Beach, the main gateway for imports from China.

The pull-forward indicates that some U.S. businesses have enough inventory to last weeks or longer before having to refresh orders. Southern California port officials expect imports to fall steeply in May.

Empty containerships

Already, companies have paused bookings for containers that ferry everything from scrunchies to batteries across the oceans. Ryan Petersen, chief executive of Flexport, a San Francisco-based freight forwarder, said China-to-U.S. bookings have declined 60% since April 9. Petersen said that for the first time since his company was launched more than a decade ago, Vietnam is a bigger origin point.

And ocean carriers have been canceling sailings across the Pacific Ocean to the U.S. Almost 30% of such journeys were canceled for the week ended May 4, according to Flexport. At the Port of Los Angeles, imports are expected to fall 35% this week compared with a year ago.

“That’s going to have a huge impact on the logistics industry,” Petersen said. “Consumers probably won’t see this until later.”

Truck orders

Truckers are bracing for a tough year by pulling back on orders for big rigs. Net orders for heavy-duty trucks in North America tumbled to 16,500 vehicles in March, down 5.9% from the same month in 2024, with the highest order-cancellation rate in almost two years, according to ACT Research.

Trucking companies had been hoping 2025 would provide a long-awaited turnaround after several years of depressed rates for the sector. Tariffs have injected a new level of uncertainty into forecasts.

ACT Research President Ken Vieth said dealer inventory levels in March hit a record 91,600 vehicles as truckers were “flirting with global financial-crisis profitability levels.”

Supply-chain activity

A measure of the global supply chain hit a five-year low in March.

The GEP Global Supply Chain Volatility Index, based on S&P Global’s monthly survey of 27,000 businesses in 40 countries, measures factors such as demand for goods, inventory levels and transportation costs. The March reading was taken as U.S. retailers and manufacturers pulled forward orders to stock up ahead of tariffs, but before Trump’s sweeping tariff announcements in April.

John Piatek, a vice president of consulting at GEP, said the biggest driver of March’s decrease was a pullback in manufacturing activity in North America while companies braced for higher purchasing costs and a possible slowdown in consumer spending. Piatek expects April’s reading will show companies cutting back further as they prepare for “worse economic conditions.”

Dow transports

Investors are positioning for more turmoil ahead. The performance this year of the Dow Jones Transportation Average, which tracks shares of shipping, railroad and logistics companies, is trailing the blue-chip Dow Jones Industrial Average by more than 9 percentage points, one of the worst showings of the past decade.

Share prices of big freight companies such as J.B. Hunt Transport Services, Knight-Swift Transportation Holdings and ocean-shipping company Matson have plunged this year.

Wall Street is closely monitoring shipping data to assess the impact of tariffs on freight logistics. These insights are proving critical for understanding shifts in trade volumes, supply chain adjustments, and broader economic trends.

Source: Article

Author

ATOS-MARelated posts

Across the Ocean Shipping at Intermodal São Paulo

It’s been a busy week at Intermodal São Paulo! We’ve had the privilege of s

Supply Chain Storm Reaching Fever Pitch

The chief executive of consultancy Vespucci Maritime, says the supply chain stor

MSC CAP/KIWI Service Suspended until further notice

In a significant update received, it has been instructed that all fresh bookings